What I did

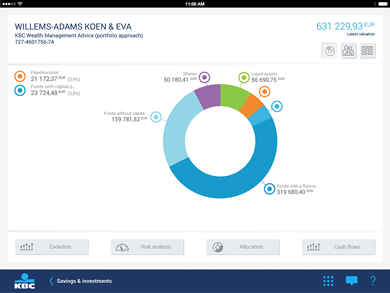

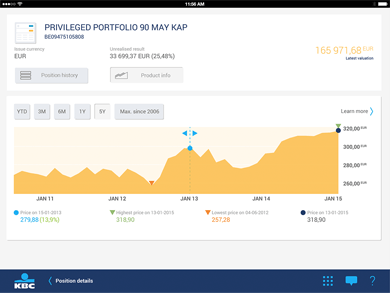

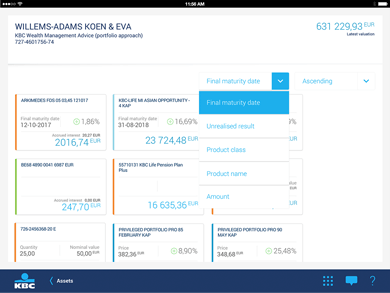

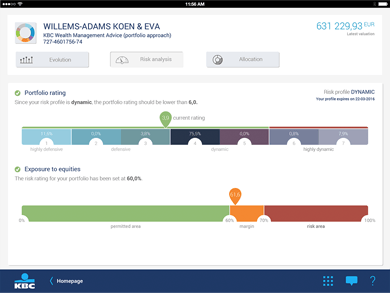

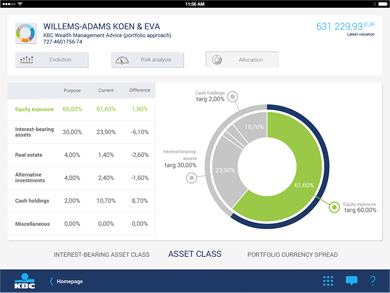

I conducted usability evaluations to test new features and functionality.

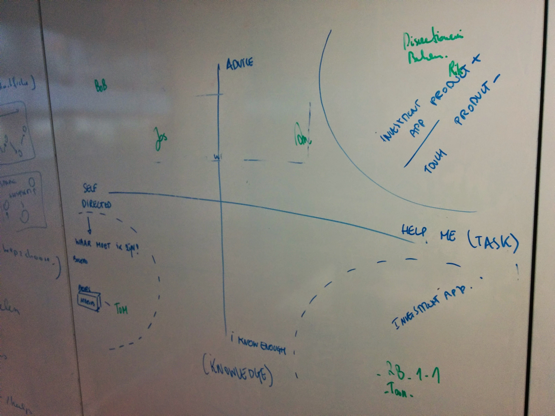

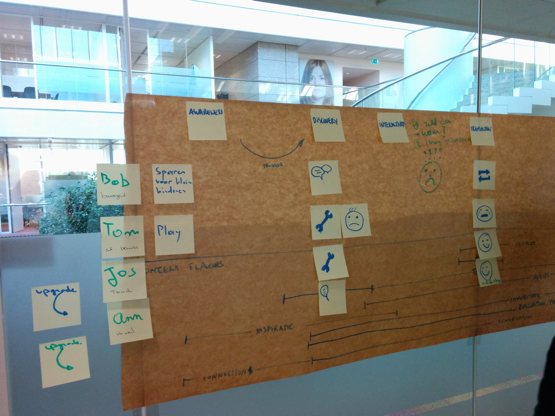

I generated new ideas for product features and improvements by means of co-creation sessions and user interviews.

To communicate both with business stakeholders and developers, I created wireframes and supervised the visual design.

I supported the developers by delivering specs and UI components, and maintaining a style guide.