What I did

I conducted interviews with both clients and account managers, and observed the quarterly report discussion, to see what is important to the client.

I observed how clients interact with the data that is available to them now, and how the account manageers use that data to inform the client about portfolio performance.

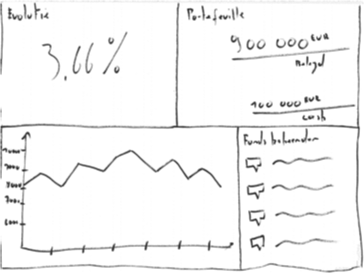

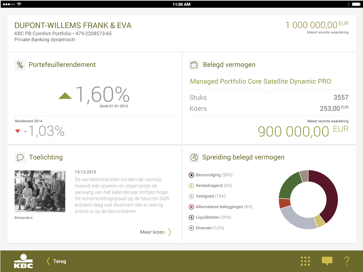

I created wireframes and concept designs to convey ideas to stakeholders and clients.

I created interactive prototypes that we used for both communication with stakeholders, and usability testing with users.